Why Should You Buy Teladoc Stock in October?

|

Meta Description: The medical industry has been transformed by telemedicine. Find out how the trend is going to impact stock prices and what you should do about it. |

October is just around the corner. If you're looking for a new investment opportunity or an alternative stock to invest in, then Teladoc could be your answer. The company's stock has been steadily rising, and it still has room to grow in October as 31 analysts suggest buying it this month. In this article, we will talk about what makes Teladoc such a great investment opportunity and why now is the time to buy!

Teladoc Position in Stock Market

The healthcare industry is changing, and Teladoc has positioned itself to be part of this change. While its stock price may not reflect it yet, TDOC offers a compelling value proposition for investors: the company has a lead in telemedicine and is taking advantage of one of the most exciting trends in healthcare today.

With only two major competitors, Teladoc could easily double or triple revenue growth over the next few years due to strong secular tailwinds alone. Following are some reasons that you should invest in Teladoc Stock.

Leadership Position

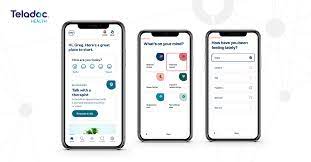

The telemedicine market is expanding from early adopters to a broader audience, and Teladoc has the best product on the market: Total Care. Teladoc partnered with more than 2,200 hospitals and health systems — the majority of which joined within the past two years.

With its breadth of partnerships across hospital systems and payers, if Teladoc can continue to grow total revenue while it penetrates existing clients, there's no reason why its revenue shouldn't double or triple over the next three years (with upside beyond that). Given the company's current revenue run rate (~$2,025 million), this equates to 109%+ top-line growth.

Unique Product Offerings

Teladoc distinguishes itself from its two main competitors—American Well and Doctor on Demand —mainly by offering a cheaper per-visit price, a broader suite of services, and a more robust EHR integration.

Teladoc charges doctors $40 for an initial virtual visit that allows her to see the patient's medical records and chat with the patient using the doctor's PC or cell phone. American Well charges physicians about $60 on average, while Doctor on Demand charges around $50 per visit.

Teladoc also offers a broader suite of services, including virtual visits with specialists, basic lab testing through Quest Diagnostics, tele-rehabilitation for people recovering from a stroke or spinal cord injury, tele-psychiatry for mental health patients, and more.

These unique product offerings increase the customer base of Teladoc, hence increasing the company's overall revenue.

Opportunity for Organic Growth

Teladoc is in the enviable position of being a leader in an industry that is forecast to grow from $0.6 billion in 2014 to above $22 billion by 2022. As with most industries in which companies are racing to establish market share, you can expect some consolidation along the way.

If Teladoc acquires its smaller rivals while maintaining its significant competitive advantages — namely its strong network of partners and access to top-notch doctors who actually use Total Care —there's no reason why Teladoc couldn't get its hands on three-quarters of the virtual visit market within five years.

Other Reasons for Investing in Teladoc Stocks

1. The company's stock has been performing well and has seen an increase in value over the last few years.

2. The stock is currently affordable (pricing at $141.98), which means you can invest without putting all your funds into one place.

3. If you purchase shares now, they'll be worth more when the market goes up again

4. You should buy Teladoc stocks because it's a worthwhile investment opportunity for people who want to make money on their investments while still being able to use them for other things like saving and spending

5. Investing in Teladoc will help diversify your portfolio, which will provide balance and stability throughout the ups and downs of the market cycle.

Conclusion

The company is already beginning to show its power in growing through acquisition by acquiring smaller companies. Combined with its strong revenue growth, this could make for an explosive stock price if the right pieces fall into place. If you are considering one of the best long-term growths for 2021, you should consider buying Teladoc stock.