Ping Identity stock has fallen by more than 12% so far this year and is currently trading at approximately US$27.76 per share. Although the company's gross profit margin has fallen from 79.23% to 72% in the past 5 years, the performance has been weak, but the company is still in a good position in the market, and it is expected to grow from US$2.3 billion in 2021 to nearly US$19 billion in 2025 In this article, I emphasized the main reason why I think Ping Identity is still an attractive stock.

Strong financial position

Ping Identity Corporation has grown exponentially in the past five years, with more than 500,000 customers worldwide, and revenue quadrupling to more than US$100 million per year.

Ping Identity has also invested heavily in research and development to stay ahead of market trends. Finally, they have more than 215 patents that have been approved or are applying for.

The company has proven its ability to create sustainable value for shareholders. In the past ten years, Ping has generated US$55.91 million in free cash flow, which is equivalent to approximately US$27.76 per share. Even if the growth is lower than expected, PING stock may still generate positive economic returns (approximately $1.60) over time.

As safe as other businesses

Security is the cornerstone of their business, including security service providers for various financial services and government agencies.

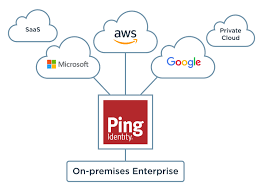

Ping Identity is helping organizations manage digital identities across different applications. The company currently supports more than 2,000 digital business plans in its customer base, with a market value of US$2.3 billion.

Unparalleled customer base

The PING market is growing rapidly driven by two factors:

· By 2022, the number of employees working remotely will exceed 1 billion.

· Digital transformation plans are pushing organizations to pursue modern identity verification strategies. Ping Identity allows its customers to use an identity provider to sign up for an account in minutes, including their own user directory. It currently supports more than 70 different providers.

Ping Identity Corporation has a large and impressive customer base, including well-known companies such as Nike, Comcast and HSBC Holdings. This is a compelling reason why investors should buy Ping stock.

Attractive dividend yield

Ping Identity’s current dividend yield is slightly higher than 1%. In addition, the company uses more than 50% of its earnings to reduce the number of annual stocks.

Since the company's trading price is much lower than cash per share, PING stock may benefit from the increase in dividend payments. Even if the management does not raise interest rates this year, there is still a lot of room for dividend growth. For reference, the current trading price of PING stock is approximately US$27.76 per share. Therefore, the company can double its dividend (yield of about 1%) without significantly affecting profitability.

Attractive relative value

Valuation indicators are also very favorable for this stock. Given this situation, Ping will almost certainly continue to outperform the market in the future.

Compared with industry peers such as Symantec Corporation and CATechnologies Inc., the trading price of PING stock is US$27.76, which is much lower than the multiples of expected earnings, market-to-sales ratio and free cash flow.

Final words

Ping Identity's revenue

growth is expected to remain stable in the next few years. However, potential

spin-offs or mergers with broader security companies such as Symantec may help

improve overall profit margins and free cash flow. Over time, this may

translate into an increase in the valuation of Ping Identity. This fully

summarizes why you should invest in PING identity.