Geopolitical tensions are reshaping the semiconductor industry, one of the most critical sectors in global technology. The complex interplay between trade conflicts, government policies, and technological innovation influences the performance of semiconductor stocks. This article examines how these factors impact the industry in 2024, highlighting key trends and challenges.

Global trade conflicts have disrupted semiconductor supply chains, causing increased costs, supply shortages, and production delays. This has forced companies to rethink supply chain management, affecting their market performance.

Global trade conflicts in 2024 have exposed vulnerabilities in semiconductor supply chains critical for modern electronics. Trade barriers, sanctions, and tensions between the U.S. and China have restricted access to essential materials like rare earth elements and semiconductor equipment, leading to production bottlenecks and higher costs. Companies diversify supply chains by seeking alternative suppliers or shifting production to more trade-friendly countries. Still, this approach often increases costs and inefficiencies, adding further challenges to the semiconductor industry.

As trade conflicts continue to escalate, semiconductor companies face rising costs due to tariffs and the need for new supply chain strategies. These costs directly affect their profitability and, subsequently, their stock valuations. Investors are increasingly wary of the volatility associated with these geopolitical disruptions, leading to fluctuating stock prices. In some cases, the uncertainty around potential future trade restrictions has caused companies to delay or reduce investments in new production facilities, further slowing industry growth.

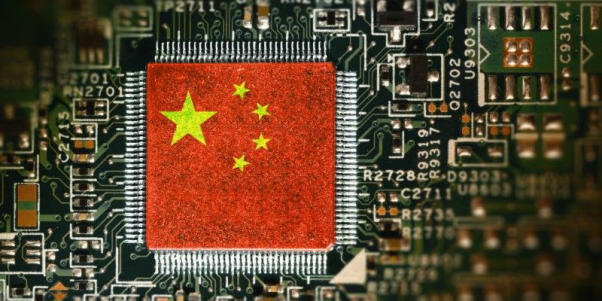

The U.S.-China rivalry in 2024 has disrupted the global semiconductor market, impacting supply chains, raising production costs, and fragmenting the industry as both nations compete for technological dominance.

The rivalry between the U.S. and China is at the heart of the global semiconductor market's realignment. Both nations recognize semiconductors as a strategic asset critical to national security and technological leadership. In recent years, the U.S. has implemented policies to restrict China's access to advanced semiconductor technologies, citing concerns over intellectual property theft and the potential military applications of these technologies. In response, China has accelerated its efforts to achieve technological independence by investing heavily in domestic semiconductor manufacturing.

Geopolitical tensions are reshaping the semiconductor industry, with U.S. firms like Intel and NVIDIA facing rising competition from China's SMIC, bolstered by government investment. Export restrictions limit U.S. companies' access to the Chinese market, prompting them to seek growth in Europe and Southeast Asia. At the same time, China focuses on developing domestic alternatives to reduce reliance on U.S. suppliers.

Government policies, driven by geopolitical tensions and national security concerns, are reshaping the semiconductor industry through tighter regulations, trade restrictions, and increased investments in domestic chip production, influencing global competition.

Governments worldwide recognize the semiconductor industry's strategic importance and are increasingly intervening to support domestic production. In 2024, the U.S., European Union, and other nations have implemented significant subsidies, tax incentives, and grants to encourage semiconductor manufacturing within their borders. These initiatives are part of broader efforts to reduce reliance on foreign suppliers and safeguard national security.

In the U.S., the CHIPS Act has been a significant driver of investment in the domestic semiconductor industry. The Act provides billions of dollars in subsidies for companies to build new semiconductor fabrication plants (fabs) on U.S. soil. Similarly, Europe's European Chips Act aims to double the continent's share of global semiconductor production by 2030. These government initiatives are reshaping the competitive landscape by providing companies with the resources to scale production and reduce dependency on foreign suppliers.

While subsidies and incentives offer growth opportunities, government regulations can also create challenges for semiconductor companies. Export controls, particularly those targeting China, have limited companies' ability to sell their products to specific markets. 2024 these controls will become more stringent as countries prioritize national security over free trade. Navigating these regulations requires significant legal and compliance efforts, adding to operational costs and reducing profitability.

Moreover, governments are increasingly scrutinizing mergers and acquisitions within the semiconductor industry, mainly when foreign companies are involved. This regulatory oversight can slow down consolidation efforts and prevent companies from achieving the economies of scale needed to remain competitive in a rapidly evolving market.

Semiconductor innovation is crucial in the global tech landscape, with geopolitical tensions driving nations to prioritize self-reliance and technological advancement, reshaping supply chains, and influencing global power dynamics.

In 2024, despite geopolitical tensions, innovation drives growth in the semiconductor industry, with significant investments in 5G, AI, and quantum computing. Companies from the U.S., China, South Korea, and Taiwan compete for technological leadership. U.S. export restrictions have pushed Chinese firms to develop advanced technologies, accelerating progress in AI chips and high-performance computing.

Innovation is a critical factor for investors in the semiconductor sector. Stocks of companies that are leaders in emerging technologies tend to perform well, even amid geopolitical uncertainties. For instance, firms at the forefront of AI chip development or those providing critical components for 5G infrastructure will likely see strong demand for their products, regardless of trade conflicts or government policies.

In contrast, companies that are slower to innovate or overly dependent on markets affected by geopolitical tensions may see their stock values decline. Investors in 2024 are increasingly focused on the long-term potential of semiconductor companies to adapt to these geopolitical shifts while continuing to deliver cutting-edge technologies.

Geopolitical tensions in 2024 are reshaping the semiconductor industry, influencing supply chains, market trends, and technological advancements. Trade conflicts, government policies, and the ongoing U.S.-China rivalry are driving companies to rethink their strategies, while technological innovation continues to be a critical factor in determining success. Understanding these geopolitical forces is essential for investors to navigate the complex landscape of semiconductor stocks.